The market opportunity for UCC vendors in the U.S. SMB segment is around $4.5B for 2016—and growing. According to SMB Group’s recently completed 2016 Small and Medium Business Communication, Collaboration and Mobility Study, although just 12% of small businesses (companies with less than 100 employees) and 28% of medium businesses (companies with 100 to 1,000 employees) currently use UCC solutions, 17% of small and 35% of medium businesses say they plan to deploy a UCC solution over the next 12 months.

UCC Drivers and Inhibitors

Unified communications and collaboration solutions help to streamline access to and management of different collaboration and communication tools such as email, instant messaging, voice, click-to-dial, presence, videoconferencing, and more by delivering them in unified, integrated fashion (Figure 1).

Figure 1: Components of an Integrated UCC Solution

Source: SMB Group, 2016

Our research shows that SMBs are considering UCC for several reasons, including to:

- Improve employee productivity from any location, device or network

- Standardize communication and collaboration tools

- Increase security

- Easier to use, monitor and manage

- Better integration between communication solutions and business applications

- Lower telecommunication costs

- Create a more professional image with customers, suppliers and partners

But, SMBs also face major obstacles that inhibit UCC adoption, including:

- Concerns about integration with other solutions

- Expense

- Lack of technical resources to implement/manage

- Concerns about flexibility and scalability

SMB UCC Vendor Preferences

Despite the fact that SMBs adopt UCC solutions for many of the same reasons that drive large enterprises to use these solutions, SMBs operate on a smaller scale. They have less IT expertise, time and monetary resources to devote to evaluating, choosing and deploying a UCC solution. In addition, SMB priorities and preferences regarding functionality, pricing, implementation, customer service and support also vary.

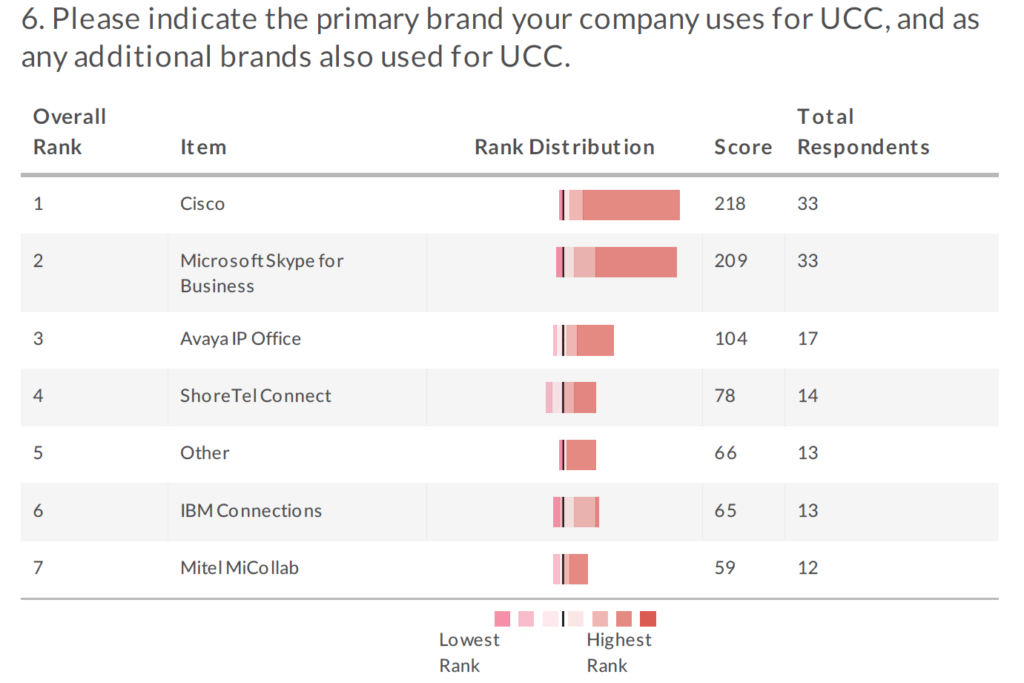

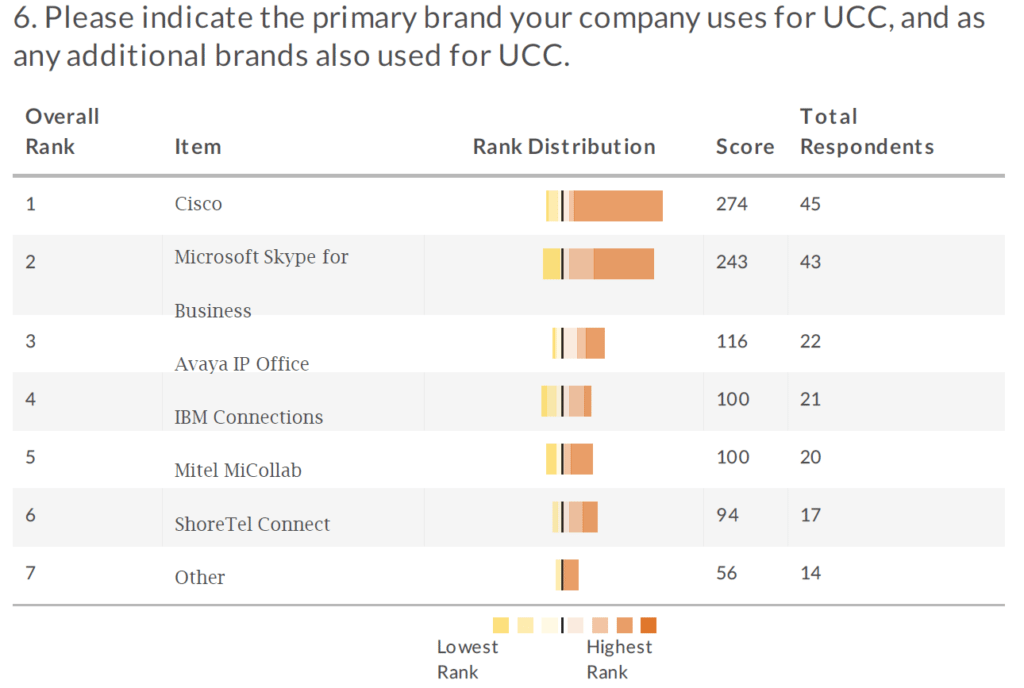

As noted in Figures 2 and 3, the SMB UCC market is fairly fragmented. The top UCC vendors include:

- Cisco BE6000

- Microsoft Skype for Business

- Avaya IP Office

- Mitel MiCollab

- IBM Connections

- ShoreTel Connect

These vendors and others have developed UCC solutions tailored specifically to SMB requirements, which they offer both directly to the SMB segment and/or in partnerships with traditional telecom or cable service providers and VARs.

Figure 2: Small Business UCC vendor preference

Source: 2016 SMB Communications, Collaboration and Mobile Study

Figure 3: Medium Business UCC vendor preference

Source: 2016 SMB Communications, Collaboration and Mobile Study

Each vendor solution has its own set of strengths and weaknesses, implementation methodologies, go-to-market strategies, and channel partner relationships:

- Cisco is still reaping the benefits of the first mover advantage with its VoIP/telephony, WebEx and BE6000 solutions. Built on its Cisco Unified Communications platform, BE6000 solutions integrate IP communications, conferencing, voice messaging, mobility, presence and IM and collaboration applications. Cisco also benefits from the customer relationships they have as a network solutions provider.

- Microsoft’s successful Office 365, which bundles Skype for Business has positioned Microsoft to rapidly gain adoption and share in the SMB segment for collaboration, despite limited telephony capabilities. Microsoft also has a large base of certified channel partners to promote Skype for Business.

- Avaya has strong brand recognition in the VoIP/telephony equipment area among medium businesses. Avaya’s primary focus has been on on-premises systems, although it does provide cloud-based unified communications solutions through its channel partners.

- Mitel has a comprehensive and mature UCC solution tuned to the needs to small and medium businesses. The solution is available as cloud, on-premises or hybrid offering and has good integration capabilities with third-party applications.

- ShoreTel has good market presence in the small business segment as it is relatively easy to use and manage, which appeals to resource constrained small businesses.

- Vendors that are doing well in the very small business segment (companies with less than 19 employees) include RingCentral and 8X8.

Perspective

UCC vendors that want to grow SMB market share need to keep the following in mind when developing product, services and go-to-market strategies for SMB customers:

- Recognize that UCC is still underpenetrated, especially among smaller companies. As noted, most SMBs don’t currently use a UCC solution. To woo the 17% of small and 35% of medium businesses that say they are planning to use UCC, vendors must make a strong case as to why a UCC will help their business—not just why their solution is better than other offerings. Vendors need to better articulate how SMBs can benefit from UCC, via assets that provide metrics and customer perspectives about how UCC provides cost, time, ease of use and management benefits over using disparate point solutions.

- Our research shows that for the most part, SMBs are making decisions about file sharing, web/video conferencing and stream based messaging independent of UCC choices. In addition, they are concerned about UCC flexibility. In other words, SMBs that use a UCC solution will probably continue to use other point solutions as well. UCC vendors need acknowledge this reality, and make it easy for customer to integrate third-party solutions that they want to use.

- The study also reveals that 63% of small and 79% of medium businesses strongly agree/agree that mobile solutions are changing how they collaborate. As working on mobile devices becomes the norm—especially for collaboration—UCC vendors and their partners must more clearly articulate and effectively address SMB challenges related to mobility and the bring-your-own device (BYOD) trend as they relate to UCC solutions.

At a macro level, UCC vendors and their channel partners need to step up education in the SMB segment to accelerate adoption, and take a more consultative approach to help SMBs better understand the business benefits and use cases for UCC.