Laurie

Today I’m talking to Neil Coleman, the chief customer officer at Plastiq, which provides an all-in-one payment platform to help small and medium businesses (SMBs) manage their cash flow. Neil, can you tell me a little bit about yourself?

Neil

Absolutely. As you mentioned, I’m chief customer officer at Plastiq, which I joined about five months ago. I’ve held similar roles at a few different start-ups over the last few years, most recently as chief revenue officer at Attune Insurance, an insurance technology company. I’m originally from Ireland, where I began my career at Google. I was at Google for about seven years, in sales, operations, and customer service-type leadership roles. I worked for Google in Ireland, India, Poland, and Michigan before landing in the Bay Area.

Laurie

And what’s the backstory on Plastiq?

Neil

Plastiq was founded in 2012. We’re based out of San Francisco, and have roughly 150 employees—and we’re growing. We have over 2 million consumer and SMB customers that have registered with Plastiq since the company was formed.

Laurie

Is the legacy and focus on the business or the consumer side?

Neil

The vast majority of our current customers are businesses. Originally the company was more consumer-oriented. Elliot, our co-founder, created Plastiq when he was trying to figure out how to pay his college tuition with a credit card. Since then, we noticed the value for businesses to have choices on how they pay and get paid, so we have evolved to a more business-centric focus to bring the flexibility we were providing to customers to businesses.

Laurie

Tell us more about what Plastiq offers to SMBs.

Neil

The short answer is that Plastiq is an intelligent payment platform that allows SMBs to choose how they pay and get paid, while preserving cash flow and syncing with their accounting workflow. It helps businesses navigate through unpredictable cash flow, helping them to find the sweet spot between managing payables and consumables so they can stay in the green and reinvest in their businesses.

Plastiq makes it easy for SMBs to pay suppliers by credit card—even when a supplier doesn’t accept credit cards. You just choose how a supplier should be paid, and Plastiq delivers the payment, which is billed to your company credit card. Plastiq pays the supplier either by check, ACH bank transfer, or wire transfer.

Our fee is 2.85% of the transaction. The fee can be offset by card rewards, and is tax-deductible as a business expense. We also have some exceptions regarding fees. For instance, if you’re putting significant payment volume through, we can discuss reducing the fee in a mutually beneficial way.

You can use Plastiq here in the U.S. and Canada, and to make foreign transaction card payments to vendors in over 45 different countries in 20 different currencies.

The seller doesn’t need to sign up to be paid, and doesn’t pay any fees, so there’s no friction in the process.

Laurie

What’s the motivation for small businesses to want to pay for more of their purchases with a credit card?

Neil

Many smaller businesses like to pay by credit card because cards typically allow them to defer payments and extend cash flow. But many vendors insist on getting paid by check. With Plastiq, you can pay for these purchases on your card, and get more time to pay for your purchase. This makes it a great cash flow management tool, especially when you’re waiting to get paid by your customers on the other end.

Laurie

Which credit cards can Plastiq customers use?

Neil

For the most part, customers can pick their own credit cards, let us know which card they want to use, and we just make the payments for them.

Laurie

You mentioned customers also use Plastiq for receivables. What’s the rationale for that?

Neil

Using Plastiq, businesses can get paid faster. We provide them with a branded payment landing page and a link that they can use to receive payments—no integrations required. And businesses don’t pay Plastiq a fee on receivables.

Laurie

So, you can work both ends of the system to get paid faster when you’re the merchant, and extend the payment window when you’re the buyer.

Neil

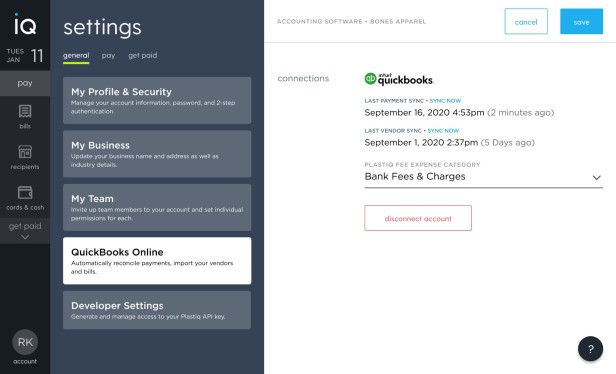

Exactly. With our all-in-one platform, you can also see payables and receivables in one system and automatically reconcile them. You can automatically import bills, suppliers, and invoices from QuickBooks and pay your bills in only two clicks. Multi-user settings allow you to create roles and permissions for your team, and reconciliations with QuickBooks Online are automated and effortless.

Laurie

This is still a new concept for many small businesses. How are you educating them about it?

Neil

There are many small businesses out there that have a need for this service, but don’t know about the solution that we provide. We are trying to get the word out through sales and marketing to create awareness and educate the market. Once small businesses understand there’s a solution that lets them use credit cards for more of their purchases, they see the value.

Laurie

What kinds of customers benefit most from Plastiq?

Neil

A wide range of customers can benefit from Plastiq, but there are a few types that seem to get the most from it. The first is high-growth businesses looking for options to fuel growth.They want to reinvest every dollar in the business, and Plastiq allows them to do that without having to wait to get paid.

The second category is businesses that have a hard time getting paid, and are spending too much time and effort chasing invoices.

The third is seasonal businesses, such as construction. They’re often very profitable but they can have high up-front costs and often have to wait months after a sale to get paid. Plastiq allows them to bridge that gap.

Plastiq is also a great solution for companies that need to make global payments. We facilitate the transfer of funds among different currencies—lifting that burden off the back of internal finance departments.

Laurie

The B2B payment space is a busy one. Where do you see Plastiq’s position in the market?

Neil

The B2B payment space is quite competitive, but there is a lot of headroom. In the U.S. today, nearly 70% of B2B payment volume is still paid by paper check—creating a big opportunity to digitize payments processes.

There are many vendors in this space, but not many that do exactly the same things as we do. Businesses find our all-in-one solution attractive because they can take care of payables and receivables in one place—and because our fee structure is very competitive.

So, although it is a massive space with lots of players, Plastiq has created a unique value proposition, particularly with our credit card focus. We also have other popular capabilities, such as ACH, for different use cases. But everything is built on one platform, works together cohesively, and integrates with QuickBooks. This gives small businesses a holistic solution. They may not use all of these at one time, but knowing that we have them all available in one place is compelling.

Laurie

Looking ahead, what are the biggest opportunities and challenges for Plastiq?

Neil

We have been growing very fast lately, and we’re still in the early phase of broader market adoption. Our recent product developments and our all-in-one solution give us a fantastic platform to build on over the coming years. We’ll be enhancing this over time, adding complementary products, and working to provide as frictionless an experience as possible from sign-up, to paying business expenses, and getting paid.

The challenge—but the opportunity as well—is to boost awareness of our products and the business problems they solve. We’re just at the tip of the iceberg. The more people who become aware of our products, see our products, and use them, the bigger the opportunity will be going forward.

Laurie

What else should people know about Plastiq?

Neil

A recent initiative that we are very proud of is our involvement with the Visa “She’s Next” Grant Program. This program celebrates Black woman-owned small businesses and helps to champion financial inclusion by awarding $10,000 grants to 10 Black women entrepreneurs in six cities (60 total). In addition to the grants, the program also includes year-long subscriptions to SMB business software, consulting services, and prepaid access for using Plastiq. People can learn more about it here.

Laurie

How can small businesses get started with Plastiq?

Neil

They can sign up for free at plastiq.com. Simply create an account online, and after that, you can begin making or requesting payments very quickly. The sign-up process is pretty intuitive so most customers can do it themselves. But if someone has a question, or needs help getting set up, we get back to them right away. We pride ourselves on providing a very high level of service.

Laurie

Neil, thank you so much for filling us in. Again, those who want to learn more can visit plastiq.com.

© SMB Group, 2021

Source: Laurie McCabe’s Blog