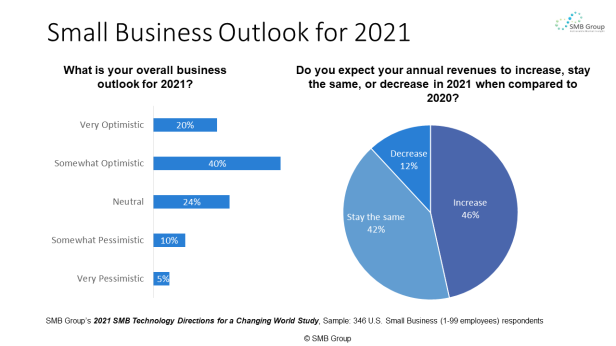

There’s little doubt that the pandemic caused major hardship for many small businesses (businesses with 1-99 employees). But, as we begin to put the pandemic behind us, small businesses are starting to feel more confident about their prospects: 60% are optimistic about 2021, and almost half believe that their businesses will survive through the COVID-19 pandemic.[1]

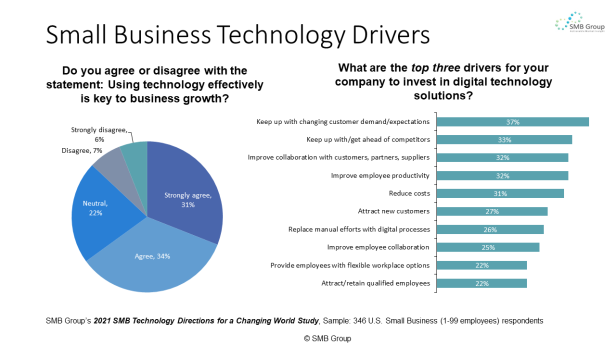

Three-quarters of small businesses agree that using technology effectively is key to business survival and growth. Top drivers to invest in new digital solutions include to keep up with changing customer demand/expectations; keep up with/get ahead of competitors; and to improve external collaboration with customers, suppliers, and partners.

However, more than half of small businesses have less than six months of cash reserves on hand to finance these and other investments. So, it’s not surprising that roughly one-third of these businesses are currently seeking or plan to seek additional loans and financing for their businesses in 2021.

But, only 29% of small businesses with fewer than 100 employees have sought financing from technology vendors in the past. With this in mind, I was very interested in talking with Thelma Regenwether, Small Business Sales and Marketing Director at Dell Financial Services (DFS) to get a better picture of the kinds of SMB financing options offered, how they work and why companies are opting for this type of financing for their technology investments.

Laurie

Thelma, it’s great to talk to you about this because as we can see from our data, many small businesses haven’t really explored technology vendor financing. Before we get into the details of what Dell Financial Services actually does for small businesses, can you provide some background on it?

Thelma

Absolutely, and it’s great to chat with you too. Dell Financial Services has been in business since 1997. We operate in over 50 countries, with 1500 team members around the globe. We like to communicate our purpose by offering the most competitive, innovative, and flexible payment solutions available in the industry today. And we make our customers successful by more competitively enabling their digital transformation.

Laurie

There are so many financing options available, from banks and fintech’s. Why should a small or medium business consider turning to DFS when they need to finance a technology purchase?

Thelma

By using DFS to finance technology purchases, you preserve your cash or other credit lines to use for other business priorities. And when you’re buying Dell technology, and using financing, you’re getting Dell as a true one-stop shop.

At DFS, we tailor our promotional offers to specific technology. And something that I’m really excited about when I compare DFS to other financing options is that we offer our promotional offers to existing customers as well as to new customers.

Laurie

That’s great. I hear about so many offers that only apply to first time customers—which is not a good way to treat your existing customers. So how does DFS work with small businesses, and what types of offerings do you have for them?

Thelma

DFS has many different offerings for different types of customers. Our most popular product at the moment is Dell Business Credit, which is a revolving line of credit that provides special financing offers for all of our top Dell small business products.^

One of my favorite offers, and I actually think this is our best product, is our Pay as You Go Technology Rotation, which we’ve designed to keep your business on a disciplined rotation cycle and stay current with state of art Dell technology. Customers using this get low monthly payments with options to either return the equipment or own the equipment at the end of the term.**

Laurie

Like leasing a car, Thelma? I mean, is that how it works?

Thelma

Yes, Pay as You Go Technology Rotation works like a fair market value lease. Another part of that program is for businesses that don’t necessarily want to rotate their products—in this case, you can still acquire the technology you need today, and take advantage of predictable low monthly payments. This really helps improve cash flow, and you can choose from multiple different term options that best suit your budgeting needs.

Laurie

What kind of products can they get through Pay as You Go from Dell?

Thelma

A really good question that we hear from our customers, too. Through Pay as You Go, you can finance Dell PCs and infrastructure products, third-party technology equipment and software, and third-party value-added services from our partners. You can finance everything you need for the total solution through DFS.

For instance, if the customer needs proprietary software for their business, we can bundle that into their DFS Pay as You Go financing. So, they are only dealing with one bill.

Laurie

Any other financing options?

Thelma

Well, at DFS and at Dell, we understand that our customers are looking for a solution that includes a lot of components. Dell has a product called PC as a Service. This includes support, asset recovery, and all of your software in one bundle with no upfront cost. DFS can finance PC as a Service with fixed monthly payments based on the price per seat per month.**

Laurie

Can you talk a bit more about returning the equipment at the end of the term?

Thelma

Yes, I’m super excited about that. Many of our customers want an easy way to return equipment, and to reduce the environmental impact. Our end-of-lease services are customer and environmentally friendly in support of the circular economy. We wipe data that exists on the equipment in a secure manner and provide green disposal practices as well. This aligns very much to our 2030 social responsibility goals, ensuring that we are doing the best we can in terms of sustainability.

Laurie

What would you say is the competitive program from DFS right now?

Thelma

I think that our most competitive offers are in the Pay as You Go Technology Rotation product and Pay as you Go Technology Ownership. It’s just offering predictable payments, the lowest payment per month option, having the best of technology at your fingertips, and offloading the burden of changing out your equipment onto Dell.

Laurie

What is involved for a small business applying for Dell financing?

Thelma

Dell.com small business customers like to self-serve, so our Dell Business Credit application only takes a couple of seconds to fill out online. You just enter your business information, you make sure you have your federal tax I.D. number, submit and boom, you get your credit decision quickly. The great thing is once you’re approved, you don’t have to wait on the mail for some card to be delivered, you can use this credit instantly on Dell.com.^

With PC as a Service, the application is online at DFS, so you can apply and buy in the same session.**

Also, even though we don’t offer our Pay as You Go products on Dell.com, we do have a Chat feature where you can talk with a Small Business Advisor and they can help you complete a Pay as You Go application.**

And our Small Business Advisors are not just trained in understanding our products, they’re trained in understanding solutions, including financing. They can walk you through the product, the support required, the services available, the software that works best on it, and the best financing product to meet your needs as well as how to complete the order.

Laurie

What kind of payment structures does DFS offer?

Thelma

Payment terms range from 12 months to 60 months, they’re flexible to meet our customers’ budget needs.

Laurie

Thelma, as you mentioned previously, Technology Rotation is a key offering. What are the benefits of this for small business?

Thelma

Technology Rotation offers a one-stop shop allowing you to maintain up-to-date technology, and you can get your hardware, software, peripherals, and your non-Dell technology and services, all with the lowest monthly payment available that we offer through very competitive financing offers. And of course, having another source to access capital.**

Another benefit is that we link financing to our product offerings, so we can customize our IT equipment with a financial offer that best meets your needs. When a customer talks to a Dell Small Business Advisor, the advisor has both financing experience and Dell Technologies IT knowledge.

And because DFS is a global company, we leverage our experience in 50 countries.

Finally, I’m really proud that our services are customer-friendly from start to finish. We make it easy for customers from the initial purchase through end-of-life for equipment with green disposal practices.

Laurie

As you know, many small businesses don’t want to stay small forever. How can DFS help them as they grow?

Thelma

A very good question, because you know what? When your company grows, we can grow with you. It’s actually quite normal for DFS to offer credit line increases, either at the customer’s request, or we do it proactively when reviewing our accounts in good standing to see how we can help them even more. We’ve been through so many different financial climates over the years, like what we’re going through right now with the pandemic, and I’ve been proud to be part of an organization that helps small businesses, helps them with promotional offers that makes us competitive and does the right thing by our customers.

Laurie

Right. And we see in our survey that over three-quarters of small businesses are confident that their businesses will survive this turbulent time. Plus, there are many new businesses starting up now, who can also take advantage of this.

Thelma, thanks for helping us to better understand how DFS works. We know that cashflow is super important to both creating and sustaining a small business —those with the most cash are the ones most likely to survive. This type of financing gives small businesses another means to control cash flow, so they get through any bumps in the road or seize on a new opportunity.

[1]All data sourced from SMB Group 2021 SMB Technology Directions Survey, March 2021

© SMB Group, 2021

^Dell Business Credit: Offered to business customers by WebBank, Member FDIC, who determines qualifications for and terms of credit. Taxes, shipping and other charges are extra and vary. Minimum monthly payments are the greater of $15 or 3% of the new balance shown on the monthly billing statement. Dell Technologies and the Dell Technologies logo are trademarks of Dell Inc.

**Payment solutions provided and serviced by Dell Financial Services L.L.C. or its affiliate or designee (“DFS”) for qualified customers. Offers may not be available or may vary in certain countries. Where available offers may be changed without notice and are subject to product availability, applicable law, credit approval, documentation provided by and acceptable to DFS and may be subject to minimum transaction size. Offers not available for personal, family or household use. Dell Technologies and the Dell Technologies logo are trademarks of Dell Inc. Restrictions and additional requirements may apply to transactions with governmental or public entities. FAIR MARKET VALUE (“FMV”) LEASE: At the end of the initial FMV Lease term, lessee may 1) purchase the equipment for the then FMV, 2) renew the lease or 3) return the equipment to DFS. PCaaS: At the end of the initial term customer may 1) extend original term or 2) return the equipment to DFS.

Source: Laurie McCabe’s Blog