I recently attended Workday’s 2022 Innovation Summit for analysts, where the executive team filled us in on where Workday has been and where it’s headed. Here are my top takeaways from the event.

FY 2022 Was a Very Good Year—And Workday Is Bullish About the Future

Workday, like many of its cloud peers, prospered during the pandemic. Company revenues topped $5 billion, up 19% from fiscal 2021. Subscription revenues rose to 4.55 billion, an increase of 20.0% from the prior year.

Workday plans to double its revenues to $10 billion over the next four years by sustaining 20% year over year growth. The vendor intends to continue to exploit customers’ desires to swap out legacy systems with cloud solutions by expanding its footprint across its core HR, financials, planning and analytics applications, its add-on solutions, and new acquisitions that may be in the pipeline.

From the Power of One to the Power to Adapt: A New Foundation for Growth

Workday has long used the “Power of One” as its unique value proposition. It professed that unlike legacy competitors, who had cobbled together different applications built on different platforms (see Brian Sommer’s Frankenstein analogy). Workday’s core HR and financials solutions were built on one, unified architecture and code base. Not only did Workday’s approach give customers a more integrated, streamlined way to manage these operations, it also gave Workday the advantage of being able to innovate more quickly.

However, no software company is an island—and Workday is no exception. Early on, the company focused on acquiring backend technology to aid in development, but more recently, Workday acquired several end-user facing applications, including Adaptive Insights, Peakon, VNDLY, Scout RFP and Zimit.

Of course, Workday had to find a way to integrate these acquisitions with the Workday core—and avoid turning into another Frankenstein itself. At the same time, it also needed to integrate the proliferation of other clouds (from cloud platforms such as AWS and Azure, to software-as-a-service clouds such as Salesforce and Microsoft Teams) that customers use in our multi-cloud world.

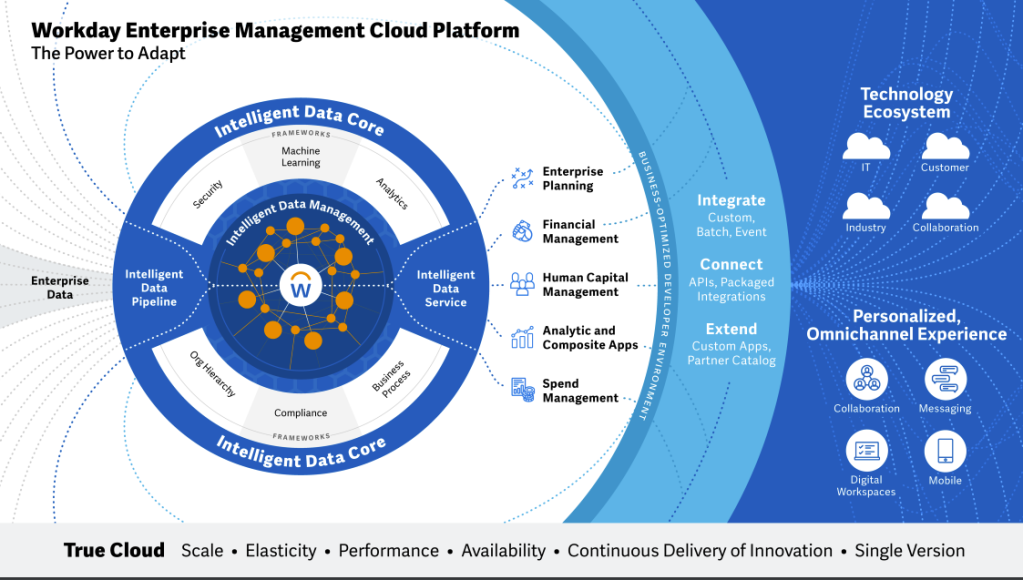

So, Workday crafted its “enterprise management cloud platform,” enabling it to deliver a set of integrated applications that run under a unified business process, common object and security framework.

Sayan Chakraborty, Workday’s EVP of Product and Technology, says that the model functions as a “digital mesh,” allowing Workday to pull different applications into Workday’s object model and business process framework to ensure seamless integrations. Using Workday Extend APIs and development tools, and Workday Orchestrate, partners and customers can also extend and build new applications that integrate with Workday—and retain the security, identity management, and system of record profiles from the Workday system.

This gives Workday customers the “power to adapt”—a more compelling value proposition that reflects how it is deeply integrating the applications it has already acquired, and a model for integrating new acquisitions that it is bound to make in the future. As important, it makes Workday a much more attractive platform for developer partners. The company now has more than 450 unique apps running on this platform, and this should enable it to significantly increase that number while maintaining quality of integrations.

Workday’s Growth Goals

The Power to Adapt serves as the bedrock from which Workday will build on four key growth goals:

- Expand wallet share. Workday claims that its renewal rates lead the industry.40% of new ACV comes from existing customers, up from about 20% a few years ago. Acquisitions such as VNDLY, which is a system of record for non-employee workers, should enable Workday to do just that in the HR realm.

- Increase mind and market share in the Office of the CFO (oCFO). Workday grew its customer base for its core Financials solution by 22% in fiscal 2022 and now has more than 1300 customers running it, along with over 5900 using Workday Adaptive Planning. The company also recently hired a new senior leader to lead industry-specific initiatives, which will be key to increasing market share in the oCFO.

- Accelerate international growth. Priority countries include the United Kingdom, Germany, France, and Australia. Workday is creating integrated sales and marketing teams specific to each of these countries.

- Grow its presence in medium enterprise. Workday defines medium business upwards of how other vendors describe it—pinning the label on organizations with 500-3500 employees. While we can quibble with the framing, the target employee-size has been a good one for Workday, especially in North America where the company enjoyed new ACV growth of over 40% year over year.

Executing on Growth with Packaged Solutions and Customer Experience

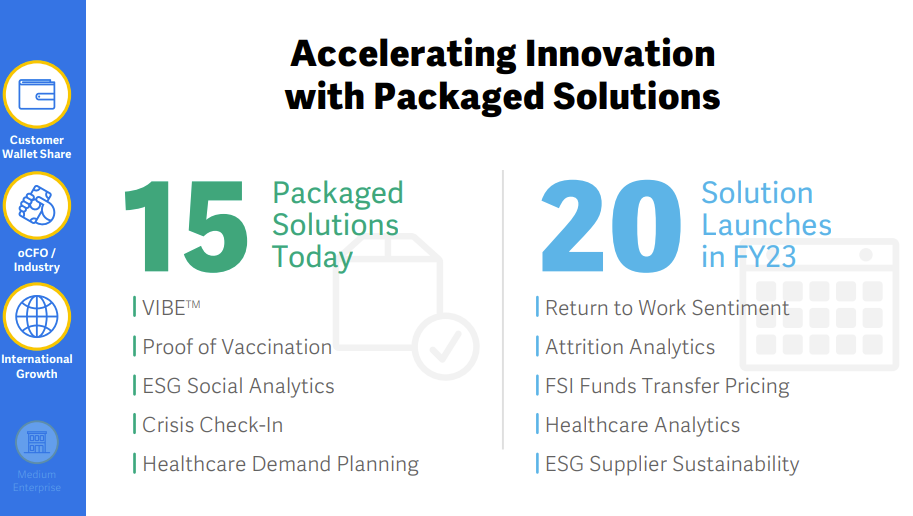

Key to all of the above is Workday’s plan to build more packaged, turnkey solutions that come with services—whether industry or country specific.

On the industry front, Workday has broken its strategy into three tiers:

- Full platform, which targets service-centric industries such as professional services, financial services, public sector, higher education, healthcare, media and entertainment, and technology.

- Platform + ISV, focusing on service-centric industries with specific supply chain management or revenue requirements. These include transportation, business services, retail, hospitality and architecture, engineering and construction (AEC).

- Corporate Finance and Workforce Management, targeting product-based industries, including manufacturing, consumer-packaged goods (CPG), life sciences, energy and resources, and telecom.

The packaged solutions approach should make Workday’s offerings more attractive in the midmarket, and also make it easier for partners to sell. To date, the company has introduced 15 packaged offerings, and has 20 planned for fiscal 2023.

Customer experience is also critical for Workday to meet its growth objectives. On that front, the vendor boasts a 97% customer satisfaction rate. Workday has also shifted to the new normal of hybrid and remote work and customers’ preferences for remote deployments: 98% of go lives in fiscal 2021 were virtual.

User experience is part of the customer experience, and elevating user experience is also a top priority. Using design thinking models, Workday is focusing on putting people at the heart of the experience. Mobile is a key investment area; Workday is designing a more tailored and engaging mobile experience so users can get things done more easily on remote devices. Workday is also improving search and navigation capabilities to get things done more quickly.

Perspective

Workday has already upset the apple cart in the HCM market, arguably becoming the premier vendor in the large enterprise space.

With its new Power to Adapt value proposition, Workday can more readily address the reality of a multi-cloud world. The more open platform makes it easier for Workday to weave new acquisitions into its own mix; gives users the ability to use Workday from other applications, such as Slack; and makes it more attractive development platform for partners that can provide additional industry, country and niche functionality that customers need.

The emphasis on providing more packaged turnkey offerings should help Workday with its oCFO goals, and make all of its offerings more accessible for medium businesses and its international targets. And it goes without saying that its ongoing commitment to customer experience—which is inseparable from user experience—will also help it drive towards its growth goals.

Workday does face some headwinds. By its own admission, its goal to hire 5,000 people will be tough to meet in this age of an acute talent shortage. However, Workday’s growth prospects, positive culture and leadership should enable it to attract more than its fair share of available talent, even if it can’t fully meet this goal. The other potential Achilles heel may be that while Workday is very focused on disrupting legacy enterprise players, the 17-year-old company needs to make sure that it isn’t blindsided by upstart disruptors in the medium business space.

But Workday’s strengths—in terms of platform, solutions, strategy and plans—seem to far outweigh these relatively minor issues. While there are no sure bets in our volatile world, it’s a very good bet that Workday has put the right puzzle pieces together to achieve its growth goals.

©SMB Group 2022

Source: Laurie McCabe’s Blog