–by SMB Group Contributing Analyst, Kelly Teal, and Laurie McCabe, SMB Group Co-founder

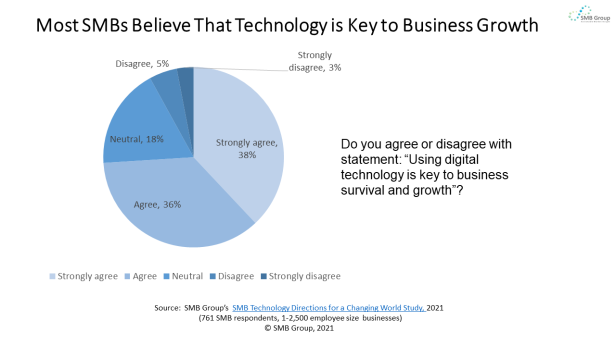

Three-quarters of SMB (small and medium business) decision-makers understand that using digital technology effectively is key to business success in today’s digital era. The right digital solutions can help businesses address new challenges, course correct, and to better prepare for unexpected changes in market and business conditions.

During this past year in particular, it’s become abundantly clear that investing in digital transformation pays off: SMBs with digital transformation initiatives underway were much more likely to report year-over-year revenue increases than peers still in the planning phase, or those with no plans. SMBs already executing on digital transformation are also more likely to expect revenues to rise in 2021 compared to other SMBs.

However, many SMBs find it difficult to develop and execute on a digital transformation strategy. Some view the “digital transformation” itself confusing and over-hyped. Is it about moving from paper to digital processes? Does it mean doing what we do today, but doing it faster? Or does it mean a complete overhaul of the technology environment, or moving everything to the cloud?

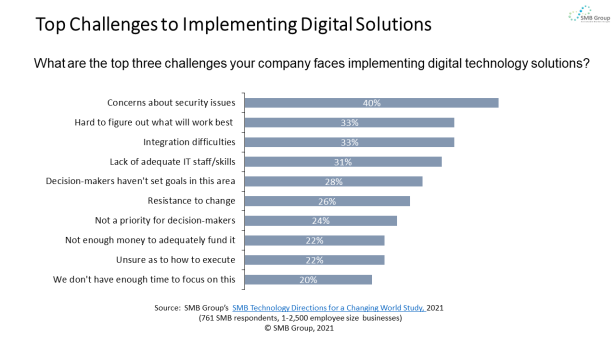

Even armed with a good understanding of the term, most SMBs still confront many other challenges. Concerns about security, integration, and just figuring out which solutions will work best, top the list. But resistance to change and the perennial “lack of” issues—lack of prioritization, money, time, skills, and staff—also get in the way.

Given these hurdles, how can CFOs help their organizations forge a successful path forward?

Digital Transformation Defined

Digital transformation encompasses more than just swapping out different technology solutions. It requires a shift in how you think about, operate, and manage the business to make it more valuable and relevant—and ultimately, to improve performance.

SMB Group defines digital transformation as “how businesses use digital technologies to create new or modify existing business processes, practices, models, culture, and customer experiences to meet changing business and market requirements.” Simply put, digital transformation is a catalyst for businesses to rethink the purpose, structure, and culture of the business.

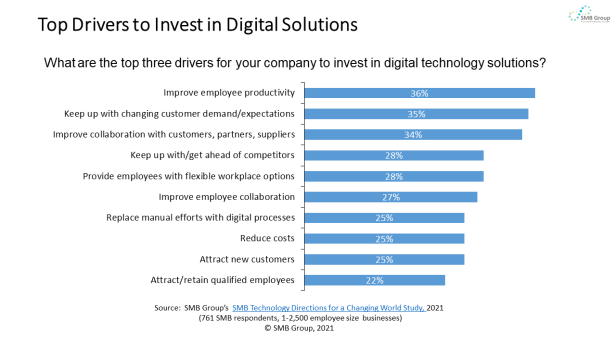

While people often focus first on business processes and business models, it’s important to keep in mind that people are the most likely impetus to digital transformation. SMBs rank improving employee productivity, keeping up with changing customer expectations, and improving external collaboration with customers, suppliers, and partners as their top three drivers to invest in digital solutions.

This means that most digital transformation initiatives must support improvements for people, not just process. For instance, helping employees do their work better cultivates creativity and growth—and ultimately, competitive advantage. Initiatives that focus on making work more efficient and intuitive mean employees can spend less time on rote tasks. They gain more time to think more strategically, better serve customers, and focus on revenue-generating work.

Digital transformation isn’t an endpoint—it will always be a work in progress. As conditions change, business and technology strategies must adjust accordingly.

The COVID-19 pandemic brought this reality into stark relief. When the implications of the pandemic hit home in March of 2020, businesses suddenly had to address three main challenges: how millions of workers could productively work in remote settings, how to serve customers virtually instead of physically, and how to create safe physical working environments when necessary. They had to deal with unanticipated supply chain disruptions, layoffs, and furloughs. As the virus recedes, companies are dealing with new issues, from hiring difficulties and creating long-term hybrid work environments to figuring out if, how, and when customers will return to pre-pandemic behaviors.

The CFO as the Catalyst for Digital Transformation

Because the ultimate goal of digital transformation is to improve business results, work often begins in the CFO’s office—and almost always includes the CFO. To provide effective guidance, financial professionals must go beyond mastering financial basics and keeping up with the latest management practices. They need to serve as strategic advisors to help decision-makers to better understand implications and evaluate options.

Successful digital transformation initiatives begin by taking a fresh look at what’s going on in the business, and with customers, employees, and competitors. Maybe revenues and profits are dipping, or it’s more difficult to recruit and retain employees. Perhaps you miss out on a great opportunity to enter a new market because it requires too many workarounds. Or a competitor has introduced a new business model that’s disrupting your business.

Zeroing in on specific issues and problem areas can help you set goals to sustain and grow the business.

The ability to communicate effectively and work collaboratively across the organization to engage people at all levels of the organization is also crucial. You need to gather input and get buy-in. While leadership must be on board to move ahead, employees must be on board to implement new business practices. Customers, suppliers, and partners can also provide invaluable input into what’s working, what’s not, and what changes are required.

Cloud-based Financials Solutions Provide a Strong Foundation for Digital Transformation

Clunky spreadsheets and brittle, client-server software can help you analyze what has already happened in the business. But decision-makers need more than a look in the rearview mirror. To successfully steer their businesses forward, CFOs need real-time information and analytics capabilities to inform overall strategy, and to identify, interpret, and execute in response to new opportunities and trends.

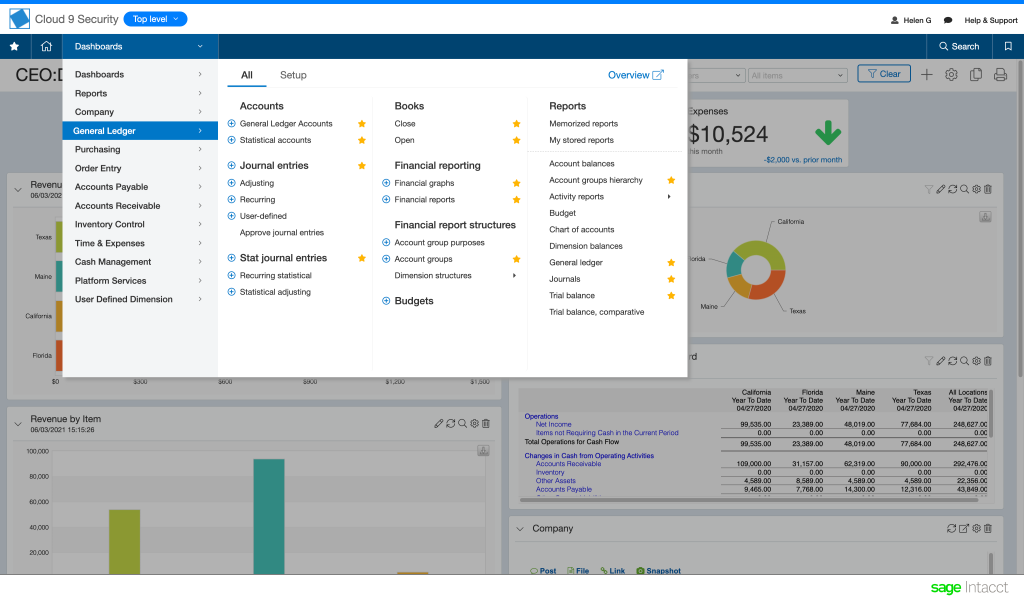

Modern, cloud-based financial systems, such as the Sage Intacct cloud-based financial management system, are designed to deliver these capabilities. People enter data into the system once, ensuring all users have the same, up-to-date information. These solutions are built with open, flexible technology, making it easy for customers to integrate new capabilities and solutions into the core financials platform.

This extensible framework also facilitates vendor innovation, such as embedding new technologies into their solutions. For instance, vendors can augment their solutions with Artificial Intelligence (AI) and Machine Learning to create and enhance predictive analytics and business modeling capabilities.

Using a flexible, extensible platform is key, as it enables you to prioritize changes and add new solutions incrementally in an integrated, cohesive manner.

These examples from Sage Intacct illustrate some practical ways to get started on and build momentum for digital transformation:

Reinvent tedious spreadsheet tasks with digital workflows

Problem: What company doesn’t have clunky workflows, such as hunting down approvers for purchase orders, expenses, time sheets, or other processes? Spreadsheets are notorious for creating issues and errors, emails get lost, and information has to be re-entered into your financial system.

Solution: Create automated, paperless workflows by switching from spreadsheets to cloud-based solutions. Using Sage Intacct, you can create a purchase order process with automated rules, messages, and triggers. Approvers can authorize or deny from anywhere, from any device, and this information flows directly into the financial system.

Results: The platform enforces the policies and rules your company sets up for different processes and shepherds the process through to completion in a collaborative, accurate, and secure manner. People spend less time on manual processes, data entry, and fixing problems, then have more time for problem-solving and creative work.

Automate data entry with smart digital processes

Problem: Many employees procrastinate when it comes to entering information into timesheets, or enter the wrong information, which then must be corrected—which leads to missing information, inaccurate numbers, wasted time, and a blurry view of true project costs. In some businesses, if just one employee fails to track up to one hour of billable time per week (meetings, presentations, email, travel time, etc.), it could add up to $10,000 worth of billable hours lost each year.

Solution: AI-powered time entry solutions, such as Sage Intelligent Time, can track time for employees by suggesting entries to them. Employees then just check, accept, or change the time as needed, or if they prefer, enter time themselves via a streamlined user interface.

Results: Employees spend less time tracking hours and more time doing productive work, and approvers put in much less effort to review and authorize. Finance gets more accurate numbers for reporting, project costing forecasting, and the business stops losing billable hours.

Evolve to digital business models

Problem: No one wants to get blindsided by change. But many SMBs lack the tools needed to pull the data and insights necessary to make the best decisions as to how to change course. They rely on spreadsheets—and the issues of spreadsheet errors, hidden formulas, broken links, or version-control issues that come with them—to guide them. These problems can lead to mistrusting the data, confusion, unnecessary disagreements about strategy—and cost companies time, money, and aggravation.

Solution: Being able to assess the situation, model possible scenarios and outcomes, and take action, is critical for business agility. Sage Intacct Budgeting and Planning complements Sage Intacct financials to give finance teams the ability to model calculations alongside many variables, such as projected cash flow, sales, revenue recognition options, or headcount expenses, and the tools to evaluate multiple scenarios. Sage’s new Outlier Detection for General Ledger product uses AI to help find errors and anomalies that typically take humans hours or weeks to detect—if they ever do.

Results: Being able to quickly shift gears as conditions change is invaluable. For example, during COVID-19, a behavioral health medical practice had to figure out how to retain, and even increase, patients using its services. Using Sage Intacct forecasting tools, the clinic successfully switched from in-person visits to telehealth, immediately increasing the number of appointments.

Digital transformation is really about business transformation. Technology powers it, but the right business strategy must lie at the core of any digital transformation initiative.

Perspective

Because accounting and finance are the system of record for most businesses, executives increasingly rely on CFOs and financial teams for insights and guidance to better understand, predict, and respond to new market, employee, and operational requirements. CFOs with more accurate, comprehensive, and timely financial information are much better equipped to provide this guidance—and help their companies successfully navigate through change.

© SMB Group, 2021

This post was originally published here.

Source: Laurie McCabe’s Blog